$2.4 Million Per BTC by 2030: ARK Invest Raises Its Bull Case Bitcoin Forecast

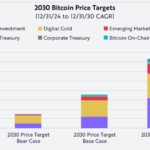

ARK Invest has significantly increased its bullish price target for Bitcoin, projecting a potential value of $2.4 million by 2030. The revised estimate, up 60% from its January 2024 outlook, stems from updated modeling that adjusts for active supply—excluding long-lost or long-held coins.This new bull case implies a 72% compound annual growth rate (CAGR) from December 2023 through 2030. ARK also outlined a base case of $1.2 million (53% CAGR) and a bear case of $500,000 (32% CAGR).JUST IN: ARK Invest updates their 2030 #Bitcoin price prediction to $2.4 million 🚀 pic.twitter.com/aWWdE6HsNxAccording to David Puell, an analyst at ARK, the valuation framework draws on Bitcoin’s total addressable market and projected penetration across several sectors: institutional portfolios, its function as digital gold, use in emerging markets as a safe haven, national treasury adoption, and the development of on-chain financial services.Trade Crypto on KrakenBitcoin’s long-term narrative is increasingly supported by strong short-term market activity. U.S. spot Bitcoin ETFs recorded $442 million in net inflows on Thursday, marking the fifth consecutive day of positive flows.These numbers followed inflows of $936.4 million on Tuesday and $916.9 million on Wednesday, showcasing robust investor appetite even as trading volume across the 12 ETFs declined to $2 billion, from $4 billion the previous day.This surge in demand comes amid broader market uncertainty, particularly surrounding U.S. – China trade tensions. Nevertheless, U.S. equity indexes posted gains on Thursday, with the Nasdaq Composite up 2.7%, the S&P 500 up 2%, and the Dow Jones Industrial Average rising 1.2%.One of the most compelling shifts in the Bitcoin narrative is its growing role as an inflation hedge alongside gold. In a recent appearance on CNBC, John D’Agostino, head of strategy at Coinbase Institutional, emphasized that sovereign wealth funds and long-duration institutional capital are increasingly turning to Bitcoin amid concerns over de-dollarization and persistent inflation.“If you think the dollar is going to weaken, then you don’t [convert Bitcoin back into dollars]. So you’re holding more Bitcoin,” D’Agostino said. “And these—again, large insurance pools, sovereigns, etc.—they’re looking at it basically three ways.”He outlined:“There’s a very short list of assets that mirror the characteristics of gold. Bitcoin is on that short list,” D’Agostino noted, highlighting attributes like scarcity, immutability, portability, and non-sovereign control.According to D’Agostino, Bitcoin consistently ranks in the top five assets among inflation-hedging models used by top commodity traders.CoinCodex’s algorithmic forecast aligns closely with macro-driven models. According this Bitcoin price prediction, Bitcoin is set to reach $130,500 within the next 90 days, driven by institutional demand, macro liquidity trends, and technical momentum.However, the model also anticipates a retracement to around $100,000, suggesting that while the near-term trend is bullish, a mid-year consolidation phase is likely.Get Started on Kraken

Published on Other News Site