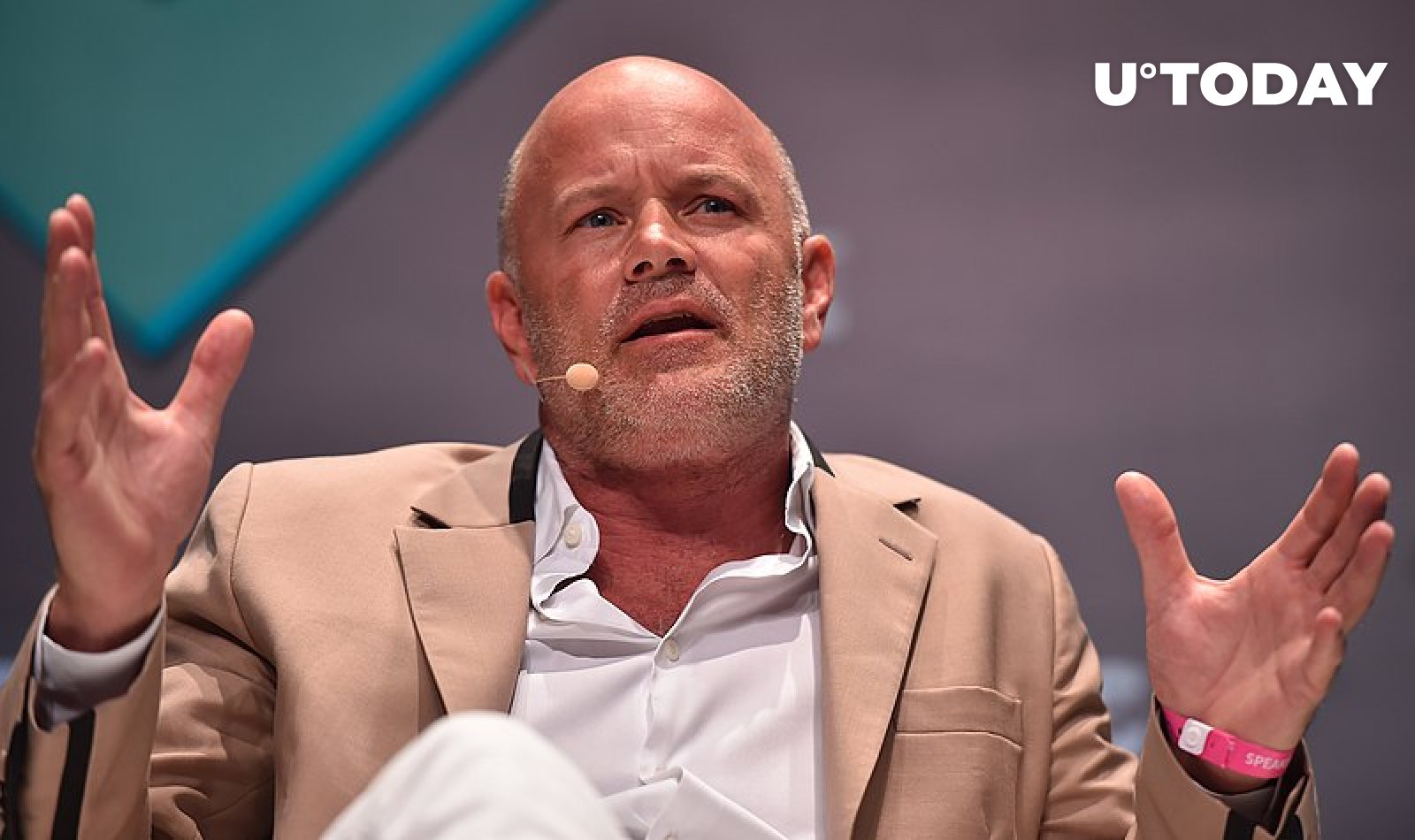

Mike Novogratz, the CEO of Galaxy Digital and a prominent figure in the digital asset space, has shared his views on the future of Bitcoin and the impact of Exchange-Traded Funds (ETFs) on retail demand.

In a recent interview with Forbes, Novogratz stressed the transformative role of traditional finance in propelling Bitcoin’s next phase of growth.

Novogratz’s optimism is significantly buoyed by the recent U. S. Securities and Exchange Commission’s approval of the first U.S.-listed spot bitcoin exchange-traded funds.

This development, according to Novogratz, marks a watershed moment for the industry, potentially heralding a new era of institutional and retail engagement with digital assets.

ETFs, with their ease of access and familiarity with traditional investors, are seen as a key driver in broadening the investor base for Bitcoin and other cryptocurrencies.

This move could address some of the liquidity and volatility concerns that have previously deterred more conservative investors from entering the crypto market.

Despite the positive momentum generated by the introduction of ETFs, Novogratz cautions about the lingering regulatory uncertainties that cloud the industry’s future

His critique extends to the regulatory approach of the SEC and the need for a more coherent and supportive legislative framework to foster innovation and stability in the crypto sector.

However, he remains bullish on Bitcoin’s role as a store of value, drawing parallels with gold.

In a separate CNBC interview, Novogratz predicted potential price corrections for Bitcoin but maintained a long-term optimistic view.

He pointed out the significant role of institutional money flowing into the market, particularly through ETFs, which could drive Bitcoin’s price higher in 2024.