USD Coin Issuer Circle Jumps 168% in NYSE Debut: Will CRCL Stock Keep Climbing?

The Circle (CRCL) IPO made waves on Wall Street Thursday, with the stablecoin issuer’s stock surging nearly 200% during its first day of trading.Shares of Circle Internet Financial exploded onto the New York Stock Exchange, opening at $69 after being priced at $31, a significant jump from the initially expected IPO range of $24 to $28. The company behind the USDC stablecoin hit an intraday high of $103.75 before closing at $83.23, representing a 168% gain. The rally continued in premarket trading Friday, with the stock up nearly 13% to $93.50.Circle is now officially a public company, listed on the @NYSE under $CRCL.

With @USDC, EURC, Circle Payments Network & more, we’re pushing forward a future of frictionless value exchange.

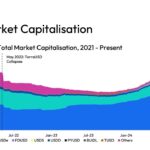

We are not just building financial products. We are building the money layer of the… pic.twitter.com/spBzjMzsVYMarket volatility was so intense that trading was briefly halted multiple times on Thursday. By the session’s end, Circle’s market capitalization had exceeded $16 billion. Trading volume reached 46 million, far surpassing the number of freely available shares.The massive demand was amplified by high-profile institutional interest. Cathie Wood’s Ark Invest acquired 4.49 million Circle shares, valued at $373.4 million, across its Innovation (ARKK), Next Generation Internet (ARKW), and Fintech Innovation (ARKF) funds. The IPO raised nearly $1.1 billion for Circle and its selling shareholders.Cathie Wood and Ark Invest bought 4,486,560 shares of Circle $CRCL today https://t.co/o3ZjYfZhRnCircle’s IPO also marks the company’s third attempt to go public, following two failed SPAC merger efforts in 2021 and 2024. Despite concerns over market headwinds tied to President Trump’s tariff policy, the listing proceeded successfully, encouraging other crypto firms like Kraken and Animoca Brands to pursue their own IPO ambitions.In the first quarter of 2025, Circle reported $578.6 million in combined revenue and reserve income, a 58.5% increase year-over-year. Its adjusted EBITA stood at $122.4 million. The firm earns most of its revenue from the interest on reserves backing its USDC stablecoin, which had $60 billion in circulation at the end of Q1.CEO Jeremy Allaire emphasized Circle’s commitment to regulatory compliance and transparency, describing the IPO as a pivotal moment in the company’s evolution. “The world is ready to start upgrading and moving to the internet financial system,” he stated on CNBC. Allaire also highlighted the firm’s history of working closely with policymakers to help integrate crypto into the mainstream financial system.Founded in 2013 and originally based in Boston, Circle moved to New York earlier this year and was the first company to receive New York’s BitLicense in 2015. It co-launched USDC in partnership with Coinbase in 2018. The two firms dissolved their joint Centre consortium last year, with Coinbase now holding a minority stake in Circle and sharing in USDC revenue.Circle joins the ranks of publicly traded crypto-native firms like Coinbase and Riot Platforms, signaling renewed investor confidence in the sector. The IPO’s timing also coincides with a crypto market rebound, fueled by political support and bullish sentiment, with Bitcoin recently surging past $110,000.With anticipated stablecoin regulation on the horizon and institutional interest heating up, analysts project a tenfold increase in the sector’s size over the next five years. For Circle, the successful IPO marks a major milestone in establishing USDC as a foundational layer in the global digital financial system.

Published on Other News Site