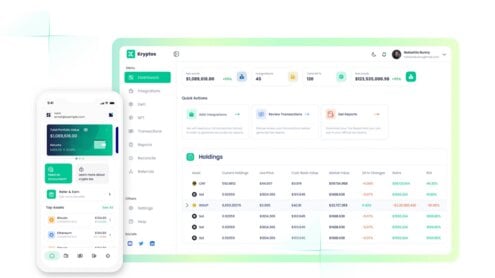

The cryptocurrency market has experienced rapid growth, attracting a significant number of investors to digital assets like Bitcoin and Ethereum. As this market expands, adhering to tax laws becomes increasingly vital. Ignoring these regulations can lead to hefty penalties and legal complications. To ensure accurate reporting and streamline the management of transactions, investors should consider using cryptocurrency tax software. These tools simplify tax calculations and help meet complex regulatory requirements. Furthermore, new regulations like the Common Reporting Standard (CRS) for the Automatic Exchange of Information (AEOI) and the European Union’s Directive on Administrative Cooperation (DAC8) mandate that major crypto exchanges report user data, underscoring the need for meticulous compliance.Cryptocurrency investors must comply with specific tax regulations. In the United States, the Internal Revenue Service (IRS) requires all crypto transactions to be reported, and any capital gains must be calculated using IRS Form 8949 and Schedule D. Similar obligations exist in other countries. For instance, in Canada, the Canada Revenue Agency mandates tracking and reporting all crypto transactions for capital gains tax. In the UK, HM Revenue and Customs requires disclosures of any transactions that result in capital gains or income. In Australia, the Australian Taxation Office insists on declaring cryptocurrencies as assets for capital gains tax. Non-compliance with these domestic and international rules can result in substantial fines and potential criminal charges.Cryptocurrency tax software enhances compliance by simplifying the tracking and documentation of crypto transactions, potentially reducing tax liabilities. These tools enable investors to fulfill their tax obligations more efficiently, calculate tax returns, and monitor unrealized gains in their crypto portfolios. Additionally, advanced features such as effective portfolio management, targeted transaction filtering, and extensive tax reporting are crucial for accurate tax computations and maintaining detailed records, providing investors with peace of mind.When selecting crypto tax software, consider the following factors:Kryptos is a reliable crypto tax software for investors seeking seamless tax compliance. It simplifies the complex process of tax calculation and report generation with powerful algorithms and an intuitive interface. Here’s how Kryptos can help solve crypto tax problems:Cryptocurrency tax compliance requires careful planning, accurate record-keeping, and a solid understanding of tax laws. Kryptos simplifies this process by integrating with various exchanges, wallets, and DeFi protocols, consolidating all transaction data into one simple dashboard. Its advanced analytics offer clear insights into transactions, portfolio performance, and tax-saving strategies like Tax Loss Harvesting. Kryptos also handles unique situations like staking rewards, airdrops, and hard forks, ensuring compliance across different investment portfolios. Supporting popular tax filing platforms, Kryptos streamlines the entire filing process from calculation to submission. With its mobile app, users can track their portfolios on the go and stay updated on market trends, all while robust security measures protect sensitive financial data.In essence, Kryptos empowers investors to confidently navigate the crypto tax landscape, optimize returns, and adhere to tax regulations in a rapidly changing market. Whether you’re a seasoned investor or just starting, Kryptos offers the tools and support needed to handle your cryptocurrency tax obligations with confidence and efficiency. By simplifying tax compliance and providing advanced portfolio management features, Kryptos helps investors focus on what truly matters—growing their investments.