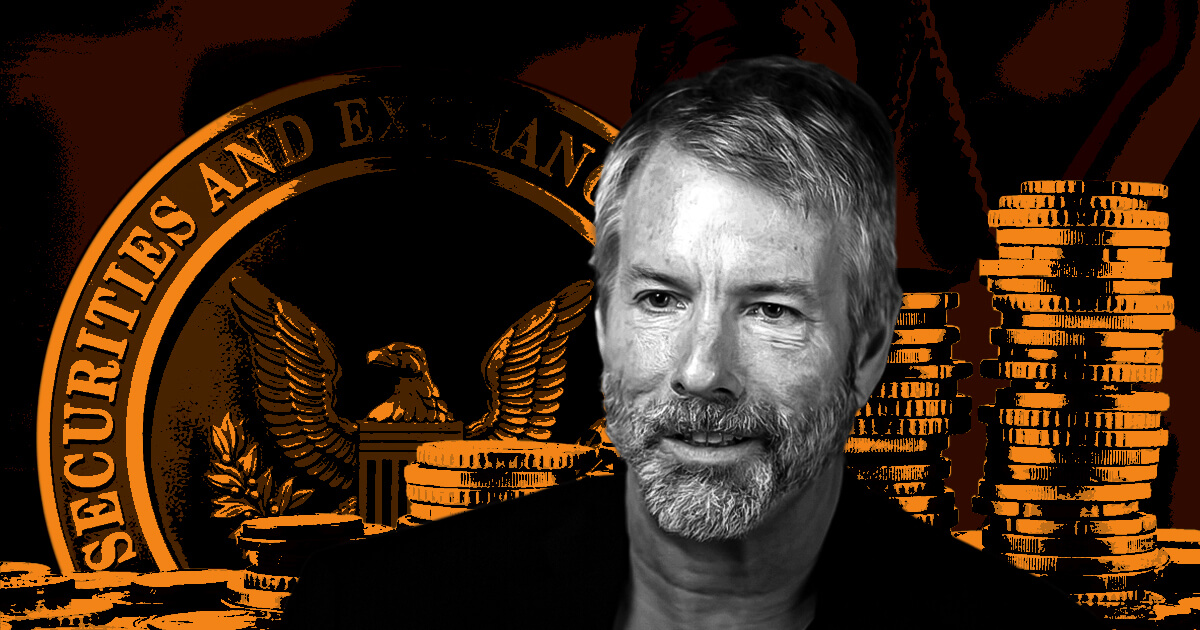

Michael Saylor and MicroStrategy settle $40 million tax fraud case without admission of guilt

Washington, D.C. Attorney General Brian Schwalb announced a historic $40 million tax fraud recovery settlement with Michael Saylor and his company, MicroStrategy, according to a June 3 press release.

Schwalb said:

“Michael Saylor – billionaire tech executive and investor – will pay $40 million to the District in the largest income tax fraud recovery in DC history. Saylor not only broke the law, he openly bragged about his tax evasion scheme and encouraged others to follow his example.”

Despite the settlement, Saylor and MicroStrategy have denied any wrongdoing. They said the agreement was made to avoid further legal complications and reduce litigation burdens.

Saylor is a vocal proponent of Bitcoin, and MicroStrategy holds more than 200,000 BTC, valued at around $14 billion.

The settlement arises from allegations that Saylor evaded over $25 million in income taxes while living in Washington, D.C.

The attorney general’s office accused Saylor of collaborating with MicroStrategy to submit fraudulent tax documents between 2005 and 2021, where they falsely reported that he was residing in Virginia or Florida, states with lower income tax rates.

However, Schlabb claimed that Saylor resided “in a 7,000 square foot Georgetown penthouse and docked multiple yachts at Washington Harbour” and further asserted:

“Saylor illegally pretended to live in lower-tax jurisdictions to avoid paying taxes on hundreds of millions of dollars of income – all while living in a 7,000 square foot Georgetown penthouse and docking multiple yachts at Washington Harbour.”

The settlement agreement has not affected shares of the Bitcoin development company.

Yahoo Finance data shows that MSTR’s shares were up by around 7% on the day and trading at $1,615 as of press time. This continues a trend of positive runs for a BTC-related stock that has risen by 133% on the year-to-date metric.

Notably, the company’s stock was added to the MSCI World Index, with BlackRock—the world’s largest asset management firm—acquiring 4,020 shares of MSTR, valued at approximately $6.1 million.

Oluwapelumi values Bitcoin’s potential. He imparts insights on a range of topics like DeFi, hacks, mining and culture, underlining transformative power.

AJ, a passionate journalist since Yemen’s 2011 Arab Spring, has honed his skills worldwide for over a decade. Specializing in financial journalism, he now focuses on crypto reporting.

Stay ahead in the crypto game: Follow us on X for daily updates and analysis.

Trading activities for the crypto ETPs were surprisingly subdued, dropping by around 40% last week.

Chainlink’s decentralized oracle network offers a solution by providing tamper-proof data feeds and real-time verification to enhance stock exchange stability.

Experts have predicted that the rising demand for Ethereum and Bitcoin could trigger a supply crunch.

The Biden administration said the resolution would have hampered the SEC’s ability to set guardrails and address issues.

Trading activities for the crypto ETPs were surprisingly subdued, dropping by around 40% last week.

Reverse engineering outdated software highlights critical flaws in random number generation, leading to successful Bitcoin wallet recovery.

Experts have predicted that the rising demand for Ethereum and Bitcoin could trigger a supply crunch.

The theft ranks among the top 5 hacking incident that has affected a Japan-based crypto platform.

CryptoSlate’s latest market report dives deep into the meteoric rise of BlackRock’s Bitcoin ETF to understand how it positioned itself at the forefront of the crypto market.

Disclaimer: Our writers’ opinions are solely their own and do not reflect the opinion of CryptoSlate. None of the information you read on CryptoSlate should be taken as investment advice, nor does CryptoSlate endorse any project that may be mentioned or linked to in this article. Buying and trading cryptocurrencies should be considered a high-risk activity. Please do your own due diligence before taking any action related to content within this article. Finally, CryptoSlate takes no responsibility should you lose money trading cryptocurrencies.

Published on Other News Site