Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U. Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U. Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

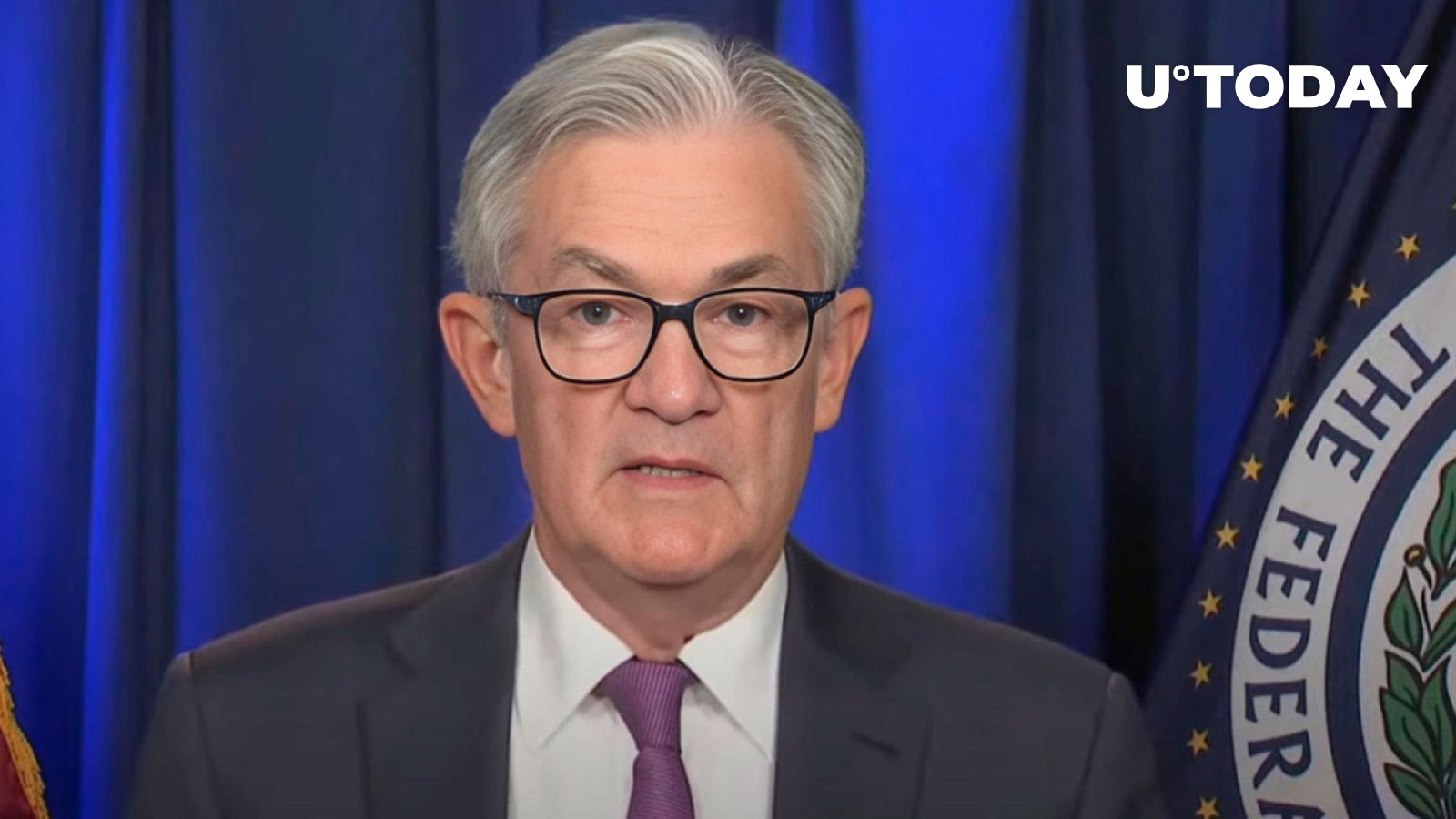

Jerome Powell, Chairman of the Federal Reserve, recently made statements that may have significant implications for financial markets, including cryptocurrencies.

Powell signaled on Thursday that an interest rate reduction may not be too far off if inflation signs cooperate. Powell reaffirmed this week that officials were still waiting for additional evidence that the economy, particularly inflation, was slowing before dropping rates, but that there was not much more to go.

Powell stated that inflation is “not far” from reaching the level required for the central bank to begin reducing interest rates. “I think we’re in the right place,” Powell said of the current policy stance.

The Fed chair’s speech comes at a time when financial markets have rallied due to expectations for Fed policy.

Gold surged to a new high on Wednesday, propelled primarily by bets on U. S. monetary easing. Bitcoin reached all-time highs of $69,000 on Tuesday, boosted by inflows into the Bitcoin ETF and an expected halving event.

At the start of the year, investors expected the Fed to begin cutting in March and continue until it cut six or seven times this year. The first cut is now expected to occur in June, with four reductions totaling a full percentage point by the end of 2024.

Riskier assets, like cryptocurrency, fell in 2022 as investors sought higher returns elsewhere after central banks raised interest rates.

While the end of rate hikes was positive for cryptocurrencies, Fed officials have indicated that rates might not fall soon. Powell stated in congressional testimony this week that inflation is falling, but not to the point where the Fed is ready to cut rates.

Expectations of subdued inflation and lower interest rates have fueled the advance on financial markets, so a delay in the Fed’s expected interest rate decreases could derail the positive narrative.

At the time of writing, Bitcoin was trading at $67,552, up 1.16% in the previous 24 hours.