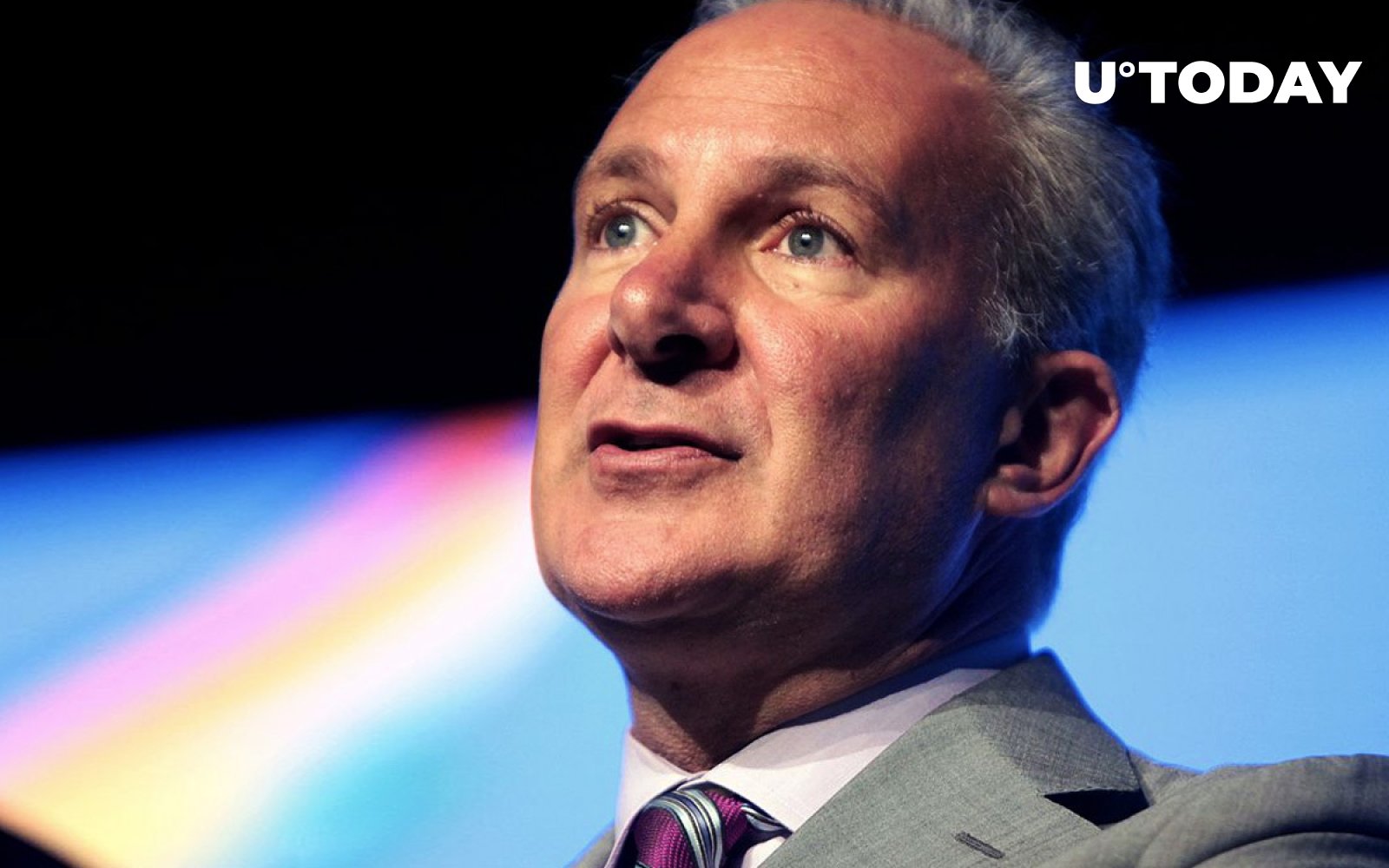

Peter Schiff, a notable critic of cryptocurrencies, has called out CNBC for its intense focus on Bitcoin and the newly launched Bitcoin ETFs, at the expense of covering significant movements in the gold market.

According to Schiff, CNBC’s coverage overlooked a noteworthy $43 increase in gold prices and the record-high price of the gold ETF, GLD.

This, Schiff argues, is indicative of a broader issue within mainstream financial reporting.

Gold prices surged to a two-month high, climbing nearly 1.5% as U. S. factory data underwhelmed and consumer sentiment dipped, fuelling speculation of impending interest rate cuts by the Federal Reserve.

The spot price of gold reached $2,075.03 per ounce, inching closer to the record high set in December 2023.

This rally was bolstered by expectations that the Federal Reserve might lower borrowing costs to support the economy, as Treasury yields fell, marking gold’s most significant intraday increase since mid-January.

Schiff’s recent posts on the X social media network further emphasize the bullish signs for gold, pointing out that the new record-high price of the GLD ETF occurred despite nine consecutive weeks of outflows, suggesting a shift from “dumb money” to “smart money.”

Schiff also called attention to the discrepancy between the strong fundamentals for gold and the weak sentiment towards gold mining stocks, which is exemplified by the world’s largest gold mining company, NEM, hitting a 5-year low just as gold prices soared.

Schiff interprets these dynamics as clear indicators of gold’s enduring value and potential for growth.

As reported by U. Today, Schiff recently dismissed the ongoing Bitcoin rally, predicting a swift crash.