Bitcoin Price Pushes Past $87K

The Bitcoin Price Breaks Resistance as the Dollar Crashes Because Trump Wants to Fire the Federal Reserve Chair Jerome Powell

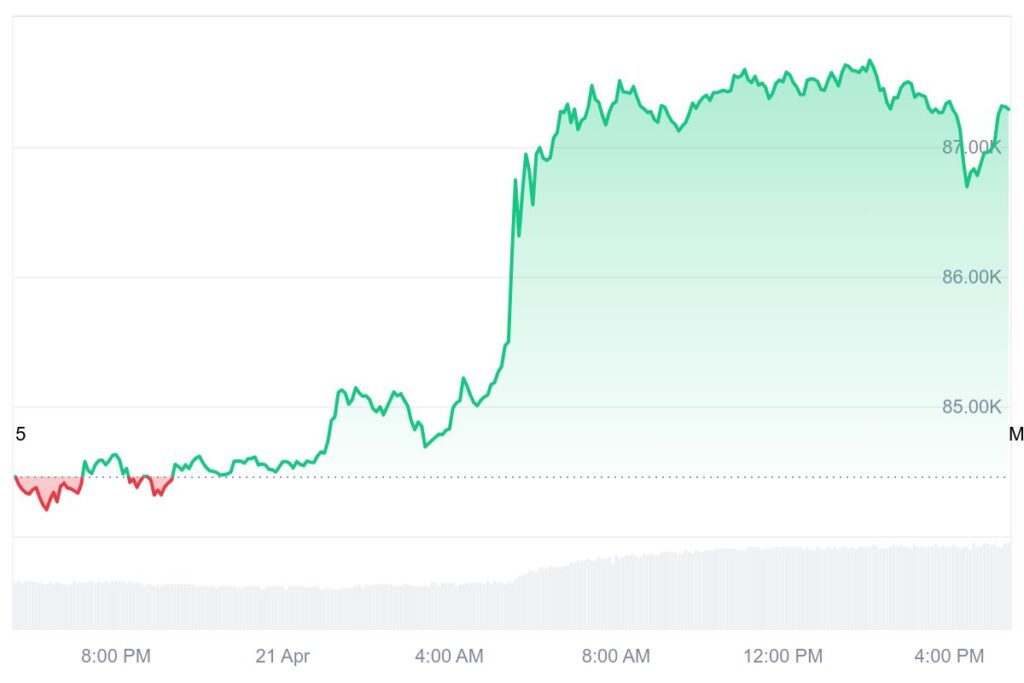

The Bitcoin price surged to touch $87,200 while the US dollar hit a three-year low. BTC outshone altcoins this morning and hit its highest price since April 2. Ethereum and other altcoins, such as XRP and ADA, also traded in green but lagged behind BTC. The leading cryptocurrency bounced off the 50-day moving average, and key analysts expect a solid close above $88K soon.

There is hope that the Bitcoin price downtrend will stop and position BTC to move to higher highs, which will lead the way for the rest of the cryptocurrency market. Whale accumulation of BTC is ramping up, which means long-term deep-pocketed investors are showing firm conviction in Bitcoin.

While Bitcoin and gold show upward momentum as hedges against currency inflation, the U.S. Dollar Index (DXY) has declined 10% year-to-date due to geopolitical tensions, rising deficits, and global trade instability. Hedge funds sold the US dollar against major foreign currencies in the forex market, and observers suggest Trump’s intention to remove Federal Reserve Chair Jerome Powell triggered this selling.

Source: CoinMarketCap

Binance CEO Advises Countries to Make Bitcoin a Strategic Reserve Asset

The Bitcoin price has yielded better returns than the Nasdaq, and as Trump’s tariffs shake equity markets, Binance CEO is advising countries to follow the US and adopt Bitcoin as a reserve asset. Richard Teng, who took over from Changpeng Zhao, has confirmed that several governments have approached Binance to establish their cryptocurrency reserves.

Binance is also helping countries with their crypto regulatory framework. With President Trump’s pro-crypto actions and legislation, the US is on its way to becoming the crypto capital. Other countries need to be wary of the USA’s growing dominance and build their crypto reserves.

Key crypto experts have suggested that the Bitcoin price could easily reach $500,000 in three years due to the creation of US Bitcoin and crypto reserves.

What Does the Forthcoming Financial Crisis Mean for the Bitcoin Price?

As global financial uncertainty intensifies, Bitcoin appears to be positioning itself as a clear beneficiary of the brewing crisis. Historically, the cryptocurrency market, particularly Bitcoin, has been regarded as a speculative investment. However, the Bitcoin price’s resilience against a falling US dollar and the surge in institutional adoption are shifting that narrative. Investors are now increasingly viewing Bitcoin as digital gold, a hedge against fiat currency devaluation and missteps by central banks.

If Trump’s threat to fire Jerome Powell becomes a reality, it could send more shockwaves through global markets. The resulting instability in the dollar could further drive up the Bitcoin price, as both retail and institutional investors seek to protect their portfolios from the fallout of currency weakness and stock market volatility. On-chain data already indicates that long-term holders and whales are accumulating, a typical sign of confidence during macroeconomic uncertainty. With growing support from influential figures in politics and finance, Bitcoin may soon cement its status as a haven rather than a speculative asset.

Conclusion

The latest surge in Bitcoin’s price is more than just another crypto rally. It reflects a changing global financial landscape, where digital assets are fast becoming part of mainstream economic strategy. Trump’s ongoing push for crypto-friendly regulation, combined with increasing global doubts about the stability of the US dollar, is setting the stage for Bitcoin to become a cornerstone of future financial systems.

Whether Bitcoin can sustain its momentum beyond the $88K mark remains to be seen, but one thing is clear: the era of dismissing Bitcoin as a passing trend is over. Institutional adoption, government interest, and the weakening dollar could drive BTC to new heights sooner than anyone expected.

About the Author: Sarah Zimmerman is a seasoned crypto and Web3 news writer passionate about uncovering the latest developments in the digital asset space. With years of hands-on experience covering blockchain innovations, cryptocurrency trends, and decentralized technologies, she strives to deliver insightful and balanced news that empowers her readers. Her work is dedicated to demystifying complex topics and keeping you informed about the ever-evolving world of technology.

Sarah Zimmerman

Published on Other News Site