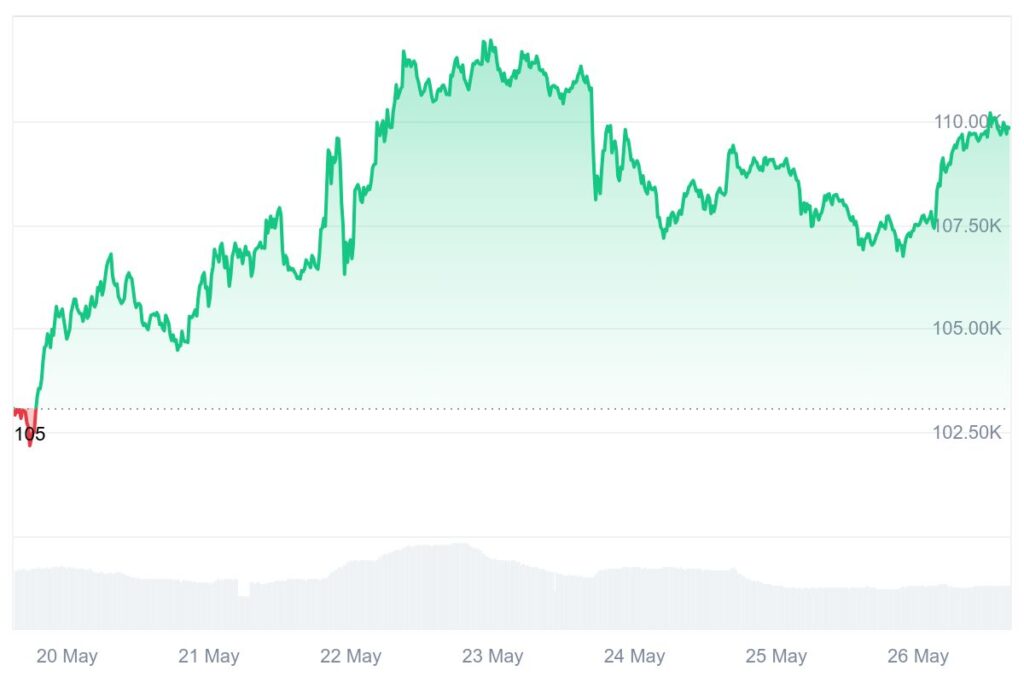

Bitcoin Price Reclaims $110K After Trump Postpones EU Tariff Decision

Bitcoin price recovered to $110K after the weekend sell-off, and because President Trump postponed the EU tariff decision. Bitcoin tailwinds helped altcoins like ADA and DOGE. The market saw over $500M in long liquidations, and market sentiment was optimistic as it positions itself for more bullish wins with a medium-term uptrend expected due to crypto ETF inflows.

The Bitcoin price rebounded to touch almost $110,000 from $106K again earlier today. The previous dip from the Bitcoin price all-time high was because of Trump’s sudden tariff threats to EY imports. After the President decided to delay the 50% tariff decision to July 9, risk appetite improved across financial markets. Reduced investor anxiety was apparent as demand for gold and U.S. Treasuries also dipped.

Among major altcoins, Cardano (ADA) and Dogecoin (DOGE) led the way and outperformed their counterparts by gaining up to 3% in 24 hours. This uptick reflects broader optimism across the cryptocurrency market as trade tensions ease.

The Bitcoin price is in a price discovery phase, and it’s unknown how high this rally will take it. This might be a dead cat bounce for the Bitcoin price, as bears may drop the price soon. Evidence shows that BTC whales have continued to accumulate BTC, and many experts continue to advocate that investors should stack the coin.

How much will 1 Bitcoin be worth in 2030?

There are many experts who say the Bitcoin price will touch $1M in 2-30, but it will invariably be a volatile asset, and making predictions with certainty is not possible. There are projections that it could soar to $500,000 within this year, but less ambitious forecasts say $111,000 to $112,000 range remains the level to watch.

As institutional investors continue to accumulate Bitcoin, there is positive pressure on the Bitcoin price to move ahead, and demand continues to outweigh supply. There is a high chance that the Bitcoin price will break more ground in the long term.

Source: CoinMarketCap

Weekend Crypto Bloodbath Recovery

The $3.43 trillion crypto market moved sideways on the weekend to $3.35 trillion, meeting the upper boundary of the previous resistance. It looks like the formation of a solid base that is preparing for the early stages of bullish momentum. As of this morning, the crypto market has pulled back from extreme greed territory, and the way for a strong bull rally has been cleared.

As sentiment recovers and options positioning turns bullish, the crypto market is recovering from a sharp decline it saw over the weekend. There was strong selling pressure because of the EU tariffs. And ETH and XRP dropped 5-7% over the weekend. The Bitcoin price also touched $106K, and crypto market liquidations soared over $600 million.

The Bitcoin price’s recovery to $110K signals renewed investor confidence following President Trump’s decision to postpone the EU tariff ruling. This easing of macroeconomic pressure, coupled with ongoing institutional inflows into crypto ETFs, has fueled optimism in the broader crypto market.

Altcoins like ADA and DOGE have followed Bitcoin’s lead, with gains reflecting bullish momentum. While short-term volatility remains, strong fundamentals—such as whale accumulation and sustained demand—suggest that Bitcoin’s medium- to long-term outlook remains favorable. With regulatory clarity improving and ETF-driven demand rising, the crypto market could be on the verge of another major breakout.

About the Author: Sarah Zimmerman is a seasoned crypto and Web3 news writer passionate about uncovering the latest developments in the digital asset space. With years of hands-on experience covering blockchain innovations, cryptocurrency trends, and decentralized technologies, she strives to deliver insightful and balanced news that empowers her readers. Her work is dedicated to demystifying complex topics and keeping you informed about the ever-evolving world of technology.

Sarah Zimmerman

Published on Other News Site