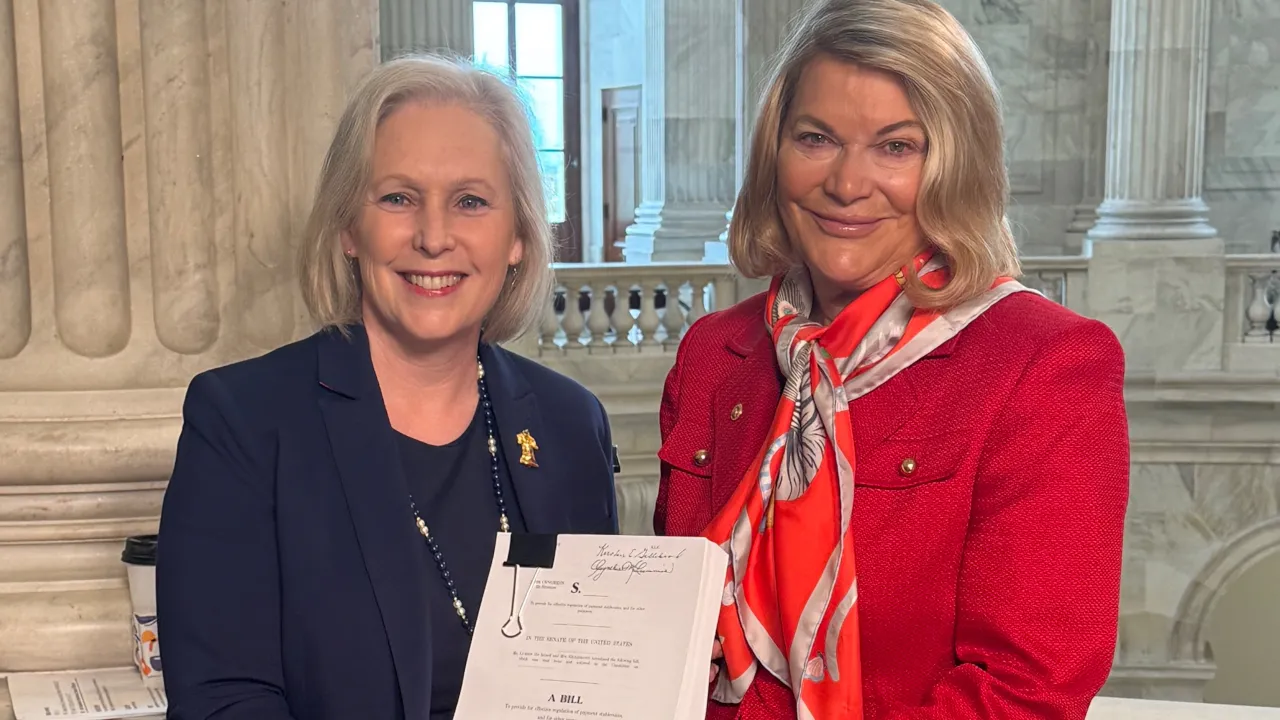

Senators Cynthia Lummis (R-WY) and Kirsten Gillibrand (D-NY) introduced fresh stablecoin legislation Wednesday, renewing lawmakers’ years-long attempt at enacting a comprehensive framework for the class of crypto assets in the United States.The The new requirement differs from how some companies have handled stablecoins in the past. For example, Binance, which is not a bank, once offered its Binance USD (BUSD) stablecoin through Paxos Trust, which is not a subsidiary of the crypto exchange. The companies’ support of BUSD, however, drew to a close after Different regulations would apply to companies depending on the outstanding value of stablecoins issued. Under the bill, dubbed the Lummis-Gillibrand Payment Stablecoin Act, a $10 billion cap is placed on state regulators’ ability to authorize and supervise non-depository trust companies involved in the stablecoin space. @gillibrandny and I are introducing the most comprehensive stablecoin bill to date.Crypto assets are revolutionizing the world and as the undisputed leader in financial innovation, the U.S. must embrace crypto assets, but it cannot be done without clear rules for stablecoins. pic.twitter.com/vwRUEBUdsl— Senator Cynthia Lummis (@SenLummis) April 17, 2024“The legislation maintains the dual banking system that is critical to preserving the parity enjoyed by the state and federal financial institutions,” Lummis Last week, Senate Majority Leader Chuck Schumer (D-NY) met with key legislators from the House Financial Service Committee to discuss stablecoin legislation, per “I think there’s momentum,” Gillibrand said in an Often referred to as the “Bitcoin Senator,” Lummis’ advocacy for crypto on Capitol Hill dates back to her election win in 2020. However, Lummis says she bought her first Bitcoin back in 2013, believing in its potential to address issues in today’s financial system.Under the new bill, it would be unlawful for stablecoin issuers in the U.S. to issue algorithmic stablecoins. Instead of using assets to back a stablecoin’s value, algorithmic coins keep their price pegged to the dollar (or other asset) with trading incentives.Additionally, the bill requires that stablecoin issuers maintain one-to-one reserves for stablecoins. Often, fiat-backed stablecoins are pegged to the dollar through a mix of liquid assets like U.S. Treasuries and cash.Algorithmic stablecoins caught attention on Capitol Hill following the The senators’ bill introduced Wednesday follows the introduction of other crypto-related bills, such as the Outlining boundaries between the regulatory authority of the Securities and Exchange Commission and Commodity Futures Trading Commission, the bill was So far, efforts to regulate crypto on Capitol Hill have died on the legislative grapevine. But Lummis is hopeful that the senators’ efforts could bear fruit before election season becomes too strong a force.“We’re going to keep pushing for weeks, rather than months,” Lummis said on “Squawk Box” Wednesday, adding that Congress is quickly approaching a period where “politics takes over policy.”Edited by Stacy Elliott and Andrew Hayward