Circle stock jumps 167% on NYSE debut

Stablecoin issuer Circle made a strong entry into the public market on June 5, with its shares climbing 167% on its first trading session on the New York Stock Exchange (NYSE).

Under the CRCL ticker, Circle’s shares opened at $31, surging 235% in the first hours of negotiation before closing at $82 at the end of the day. The company’s performance hints at a growing market appetite for stablecoin businesses.

The oversubscribed round had some significant tailwinds. On May 28, the world’s largest asset manager, BlackRock,revealed it was eyeing a 10% stakein the IPO. Cathie Wood’s ARK Investment was reportedly interested in buying $150 million worth of shares of the offering.

The demand led Circleto boost its offerto a marketed range of $1.05 billion, with 34 million shares available to investors.

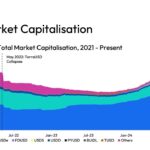

Circle is behind the dollar-pegged stablecoin USDC (USDC). The company has beenworking on the offerfor the past few months, but ultimatelydelayed plans citing macroeconomic uncertaintycaused by ongoing trade wars.

Related:USDC issuer Circle debuts public trading on New York Stock Exchange

Arca executive criticizes Circle IPO

In a now-deleted X post, Arca Chief Investment Officer Jeff Dormantrashed the Circle IPOon June 5, criticizing the company for only granting Arca a $135,000 allocation in the initial public offering.According to Dorman, Arca is one of Circle’s earliest backers. “Most of us stick together and help each other,” the letter read, adding that:

“Most of Arca’s management team left Wall Street eight years ago to start a crypto-native company specifically to get away from TradFi clowns like you,” Dorman continued. “Ironically, you’ve come full Circle.”

Legal Panel: Crypto wanted to overthrow banks, now it’s becoming them in stablecoin fight

Explore more articles like this

Subscribe to our Crypto Biz newsletter

Weekly snapshot of key business trends in blockchain and crypto, from startup buzz to regulatory shifts. Gain valuable insights to navigate the market and spot financial opportunities. Delivered every Thursday

By subscribing, you agree to ourTerms of Services and Privacy Policy

Published on Other News Site