Circle’s Allaire: Stablecoins Could Expand by Trillions in 10 Years, Will Be Integral Part of Global Financial System

Election 2024 coverage presented by

The stablecoin market could grow to a $5 trillion to $10 trillion market in 10 years as digital money wins a larger slice of the global financial system, Jeremy Allaire, CEO of Circle, the company behind the USDC and EURC stablecoins, said in an interview with CoinDesk.

Allaire said he envisions stablecoins – a type of cryptocurrency whose value is pegged to a conventional currency like the U.S. dollar or euro – capturing a 5% to 10% share of a global money supply of $100 trillion over the next decade as the technology spreads like previous internet-based innovations such as video streaming and online shopping.

“We are at the very early stages of stablecoin adoption but over the next 10, 20 years, this technology will be part of the global financial system,” he said.

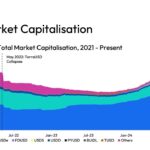

Stablecoins are one of the most popular innovations in crypto, bridging government-issued fiat currencies on traditional financial rails with blockchain-based digital assets, facilitating trading and transactions. Taken together, all stablecoins have a market capitalization of about $170 billion. Because of their non-volatile nature combined with blockchain’s speed and near-instant settlements, they are increasingly used for everyday economic activities such as payments and remittances, especially in developing countries with less robust banking systems and rapidly devaluing local currencies like Argentina and Nigeria.

Circle’s USDC token is the second-largest stablecoin on the market, growing to $35 billion since it was started six years ago with crypto exchange giant Coinbase. It’s bigger rival, Tether’s USDT, has a $120 billion market cap. Market observers partly attributed Tether’s faster growth to its focus on emerging regions where dollar access is limited versus Circle’s focus on developed and heavily regulated markets like the U.S. and European Union.

Allaire, however, said he sees substantial growth of USDC use in emerging markets such as Latin America and Southeast Asia, especially among fintech companies servicing local businesses and households.

One of the “cool examples,” Allaire said, is that more local foreign currency brokers specializing on cross-border payments and currency conversions leveraging USDC for settling trades between small and medium enterprises. Another instance was an anecdote from one of Circle’s partners who told Allaire about “a multi-$100 million energy order between a supplier in the Middle East and a buyer in Africa” that was facilitated by USDC.

Another example of growing USDC adoption as a payments vehicle is U.S.-based fintech firm Stripe reintroducing USDC transactions for merchants this October. In the first 24 hours, users from 70 countries chose the USDC payment options, Stripe product manager Jennifer Lee posted on X.

“There’s a new [company] every week that uses USDC, and they don’t even have to do deals with us” to build and use Circle’s products, he said. “The beauty of what we’ve built is it’s an open, public infrastructure for digital dollars on the internet.”

Circle laid out plans to go public earlier this year, but the upcoming U.S. elections in November and the uncertainty about the next administration’s view on crypto weighs on many U.S.-based digital asset firms.

Allaire said he remains committed to taking the company public regardless of who wins the elections in November, but acknowledged that the results may potentially impact the timeline when it could become reality.

“Circle is focused on building a highly transparent and compliant financial infrastructure, and we believe becoming a publicly traded company will reinforce that trust and accountability,” he said.

He emphasized that stablecoin legislation enjoys bipartisan support in the U.S., and the Payment Stablecoin Act is at a very advanced stage.

It’s not just the U.S. Regulating stablecoins is a top priority globally and next year will be pivotal, Allaire said.

“Most major financial hubs already have stablecoin laws that are either on the books or are in consultation or in the legislature,” he said. “By the end of 2025, huge numbers of G20 countries and many emerging markets will have stablecoin regulation.”

Edited by Stephen Alpher.

Disclosure

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information have been updated.CoinDesk is an award-winning media outlet that covers the cryptocurrency industry. Its journalists abide by a strict set of editorial policies. CoinDesk has adopted a set of principles aimed at ensuring the integrity, editorial independence and freedom from bias of its publications. CoinDesk is part of the Bullish group, which owns and invests in digital asset businesses and digital assets. CoinDesk employees, including journalists, may receive Bullish group equity-based compensation. Bullish was incubated by technology investor Block.one.

Krisztian Sandor is a reporter on the U.S. markets team focusing on stablecoins and institutional investment. He holds BTC and ETH.

Published on Other News Site