This article originally appeared in First Mover, CoinDesk’s daily newsletter, putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

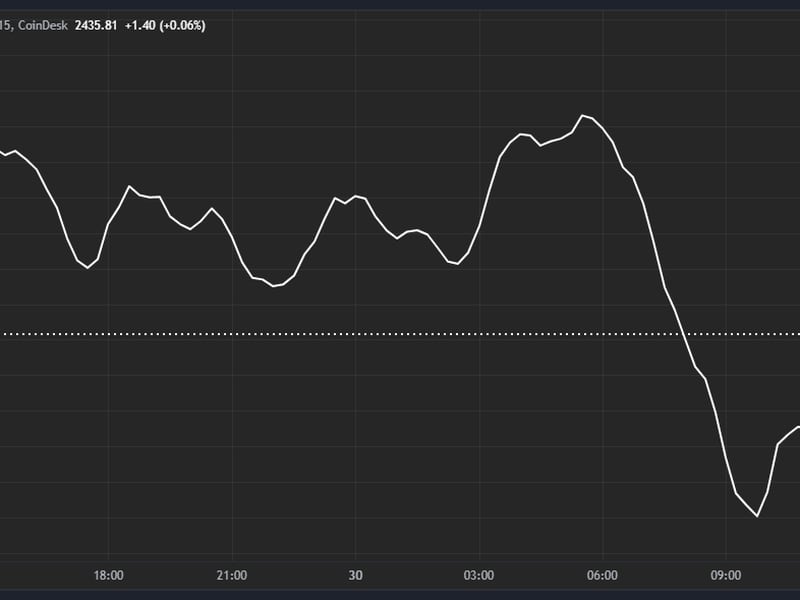

Bitcoin (BTC) held its own below $68,000 during the European morning while several altcoins lost as much as 5%. BTC is priced just under $67,800 at the time of writing, practically unchanged over 24 hours. The CoinDesk 20 Index (CD20) lost nearly 2%, with meme coins SHIB and DOGE leading the declines, down 5.2% and 3.7% respectively. Traders are looking toward Friday’s U.S. PCE announcement, which Japanese crypto exchange bitBank warned could spell further losses. “If the inflation data comes in hotter than expected, bitcoin could give up about a half of its gain in the past two weeks and decline to around $65,000,” bitBank said in an email to CoinDesk.

The listing of a spot ether ETF by the end of June is “a legit possibility,” Bloomberg analyst Eric Balchunas said after BlackRock filed an amended S-1 form, revealing a “seed capital investor” had purchased the initial shares for the proposed product. “On May 21, 2024, the Seed Capital Investor, an affiliate of the Sponsor, subject to conditions, purchased the Seed Creation Baskets, comprising 400,000 Shares at a per-Share price equal to $25.00,” the S-1 form showed. “The net asset value of the Trust was $10,000,000.” Subject to regulatory approval, assets held in the ETF can be redeemed for cash or even ether. The iShares Ethereum Trust ether ETF will list and trade under “ETHA.”

The New York Stock Exchange would consider offering crypto trading if the regulatory status was clearer, the company’s president said at Consensus 2024 in Austin, Texas. Lynn Martin referred to cryptocurrency trading as “an opportunity to look at,” in a panel discussion on Wednesday. “The fact that you’ve seen $58 billion or so come to the ETFs has been a strong sign that the market is looking for regulation in traditional structures,” Martin said. “So, hopefully, the [SEC] saw the inflows and said, ‘Hey, this makes a lot of sense,’ considering bitcoin ETFs have been a tremendous success.” NYSE’s U.S.-based rival, the Chicago Mercantile Exchange is planning to launch spot crypto trading to clients, the Financial Times reported earlier this month.

– Omkar Godbole

Edited by Sheldon Reback.

Disclosure

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.CoinDesk is an award-winning media outlet that covers the cryptocurrency industry. Its journalists abide by a strict set of editorial policies. In November 2023, CoinDesk was acquired by the Bullish group, owner of Bullish, a regulated, digital assets exchange. The Bullish group is majority-owned by Block.one; both companies have interests in a variety of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin. CoinDesk operates as an independent subsidiary with an editorial committee to protect journalistic independence. CoinDesk employees, including journalists, may receive options in the Bullish group as part of their compensation.

Jamie Crawley is a CoinDesk news reporter based in London.

Omkar Godbole is a Co-Managing Editor on CoinDesk’s Markets team.

Learn more about Consensus 2024, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.