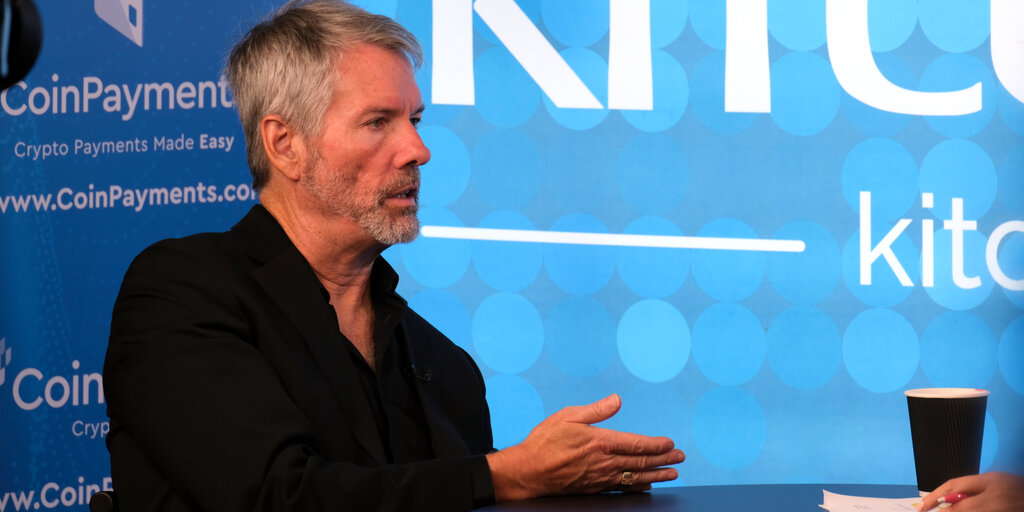

In an interview with Bloomberg Television on Tuesday, MicroStrategy co-founder and chair Michael Saylor said the recently approved spot Bitcoin ETFs have opened a gateway for institutional capital to flow into the Bitcoin ecosystem, with demand outpacing the current supply.

“This is a rising tide; it’s gonna lift all boats. MicroStrategy is got a levered operating strategy for Bitcoin,” Saylor told Bloomberg’s Katie Greifeld. “But if you look at what the spot ETFs are doing, they’re facilitating the digital transformation of capital. And every day, hundreds of millions of dollars of capital is flowing from the traditional analog ecosystem into the digital economy.”

While the U. S. Securities and Exchange Commission approved the Bitcoin ETFs, chair Gary Gensler told CNBC the approvals were not an endorsement of the digital asset.

“As we like to say, we’re merit-neutral,” Gensler said. “This was not in any way an approval of Bitcoin that existed—it’s just how to trade it in these Exchange Traded products.“

A prominent holder of Bitcoin, MicroStrategy has accumulated over 190,000 BTC, worth around $10 billion. For his part, Saylor has been anything but traditional regarding how he and MicroStrategy invest in Bitcoin.

“I’ve famously said, I’m going to be buying the top forever,” Saylor said. “Bitcoin is the exit strategy, it is the strongest asset, so what we see right now is that Bitcoin just emerges as a trillion-dollar asset class. And it’s alongside names like Apple, Google and Microsoft.”

Last year, despite widening losses, MicroStrategy continued to buy Bitcoin. In January, Saylor sold $216 Million in personal MicroStrategy stock options to buy more Bitcoin.

“There’s not a lot enough room in the capital structure of those companies to hold 10 trillion or $100 trillion worth of capital,” Saylor said. “So Bitcoin is competing against gold, which is 10x. What it is right now, it’s competing against the S&P index, is competing against Real Estate $100 trillion-plus asset class as a store of value.”

Calling Bitcoin technically superior to these asset classes, Saylor said he believes capital will continue to flow out of those asset classes into Bitcoin.

“That being the case, there’s just no reason to sell the winner to buy the losers,” Saylor concluded.