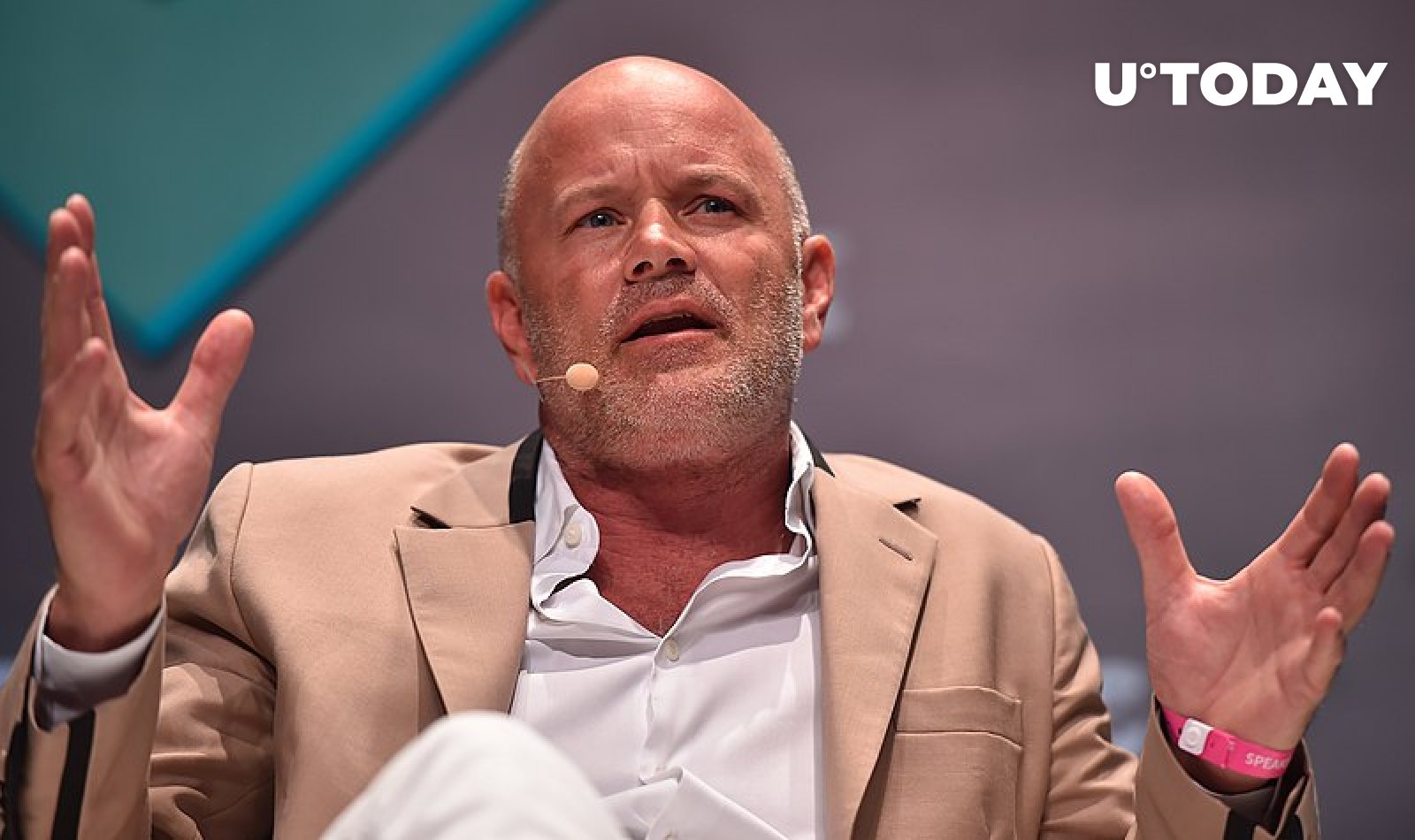

In a recent interview with Fox Business, Michael Novogratz, a prominent figure in the cryptocurrency world, expressed his belief that Bitcoin could reach the milestone of $100,000 within the next year.

His prediction comes amidst a backdrop of fluctuating prices, where Bitcoin has seen a rapid ascent to new heights, only to experience significant pullbacks.

Novogratz noted the cryptocurrency’s potential to oscillate between $58,000 and $69,000 as it stabilizes before making a stronger push upwards.

“It wouldn’t surprise me if we bounce between $58,000 and $69,000 until some of its buying gets digested, and then the next move up,” he said.

He stressed the increasing momentum in exchange-traded funds (ETFs) as a key driver for this growth, suggesting a bullish outlook for the digital currency.

“It’s really hard to say right because there’s almost like runway momentum in these ETFs,” the crypto mogul added.

As reported by U. Today, Bitcoin recently shattered its previous all-time high, soaring above $69,200. This surge in value has brought the cryptocurrency’s market capitalization to over $1.3 trillion.

The rise has been attributed to a variety of factors, including increased adoption by institutional investors and a general bullish sentiment in the cryptocurrency market.

However, despite this peak, Bitcoin experienced a significant drop, falling below $60,000, before regaining ground to around $66,000.

This volatility underscores the cryptocurrency’s unpredictable nature and the “frothy levels” it can reach, as described by analysts.

In a Bloomberg interview conducted six days ago, Novogratz described the current state of cryptocurrency assets as “very frothy.”

He pointed out that the market was experiencing unprecedented price discovery, driven by a new wave of investors, including baby boomers.

The shift of a small percentage of their wealth into cryptocurrencies could represent a significant influx of capital, further propelling the market.

However, Novogratz also cautioned about potential corrections and consolidations, indicating a complex and uncertain path forward for Bitcoin and other cryptocurrencies.