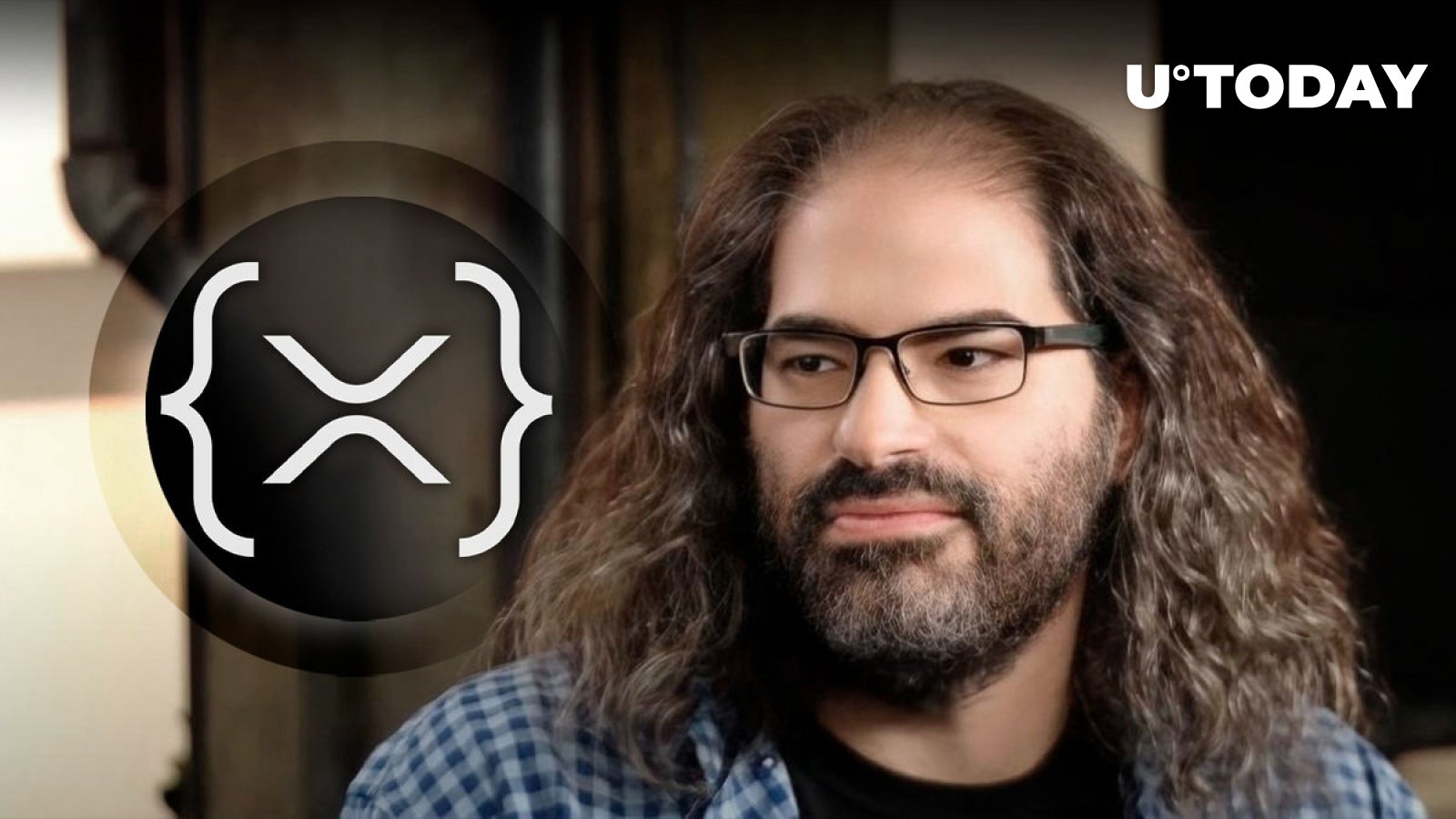

Ripple chief technology officer David Schwartz has published a tweet in which he rushed to address recently rolled out AMMs on XRP Ledger. He did it as a clarification of what has happened, going into details on how Ripple’s AMMs on XRPL work.

The Automated Market Maker feature (AMM) was launched on the XRP Ledger on Friday, and the Ripple CTO published a celebratory tweet about that over the weekend. However, shortly after that, a major bug emerged on AMM, causing its temporary suspension. The RippleX developer team has already identified this discrepancy in several AMM liquidity pools, and they are working to fix it.

David Schwartz tweeted that the above-mentioned issue was not caused by the single-sided deposit feature embedded into AMMs. Here he repeated his warning from Saturday about this type of deposit – they “allow for a more streamlined user experience, but can lead to price impacts when pools have less liquidity.” Previously, he warned that these “price impacts” basically mean a loss for traders during the deposit process – the system reports it as “slippage.” However, the CTO warned, it should happen very seldom since, if the AMM stays out of balance, it most likely means that other traders are missing an opportunity to make a profit on it as well.

The advice offered by David Schwartz for trading via these new AMMs in the future is this: “It’s best for users to review the price impact in their tooling before submitting a transaction and front-end apps should display this information to users.”

RippleX developer (creator of the Xumm Wallet) Wietse Wind published a tweet in which he stated that the issue with the AMM bug on XRP Ledger requires the creation of a Canary Network on Ripple’s layer-1 blockchain.

The Canary Network, per Wind, would serve as a test-bed for various major upgrades, tools and products before they go live on the mainnet.

Wietse insisted that if such a testing ground had existed and the AMM feature had been tested on it, the recent major issue would have never taken place on XRPL.