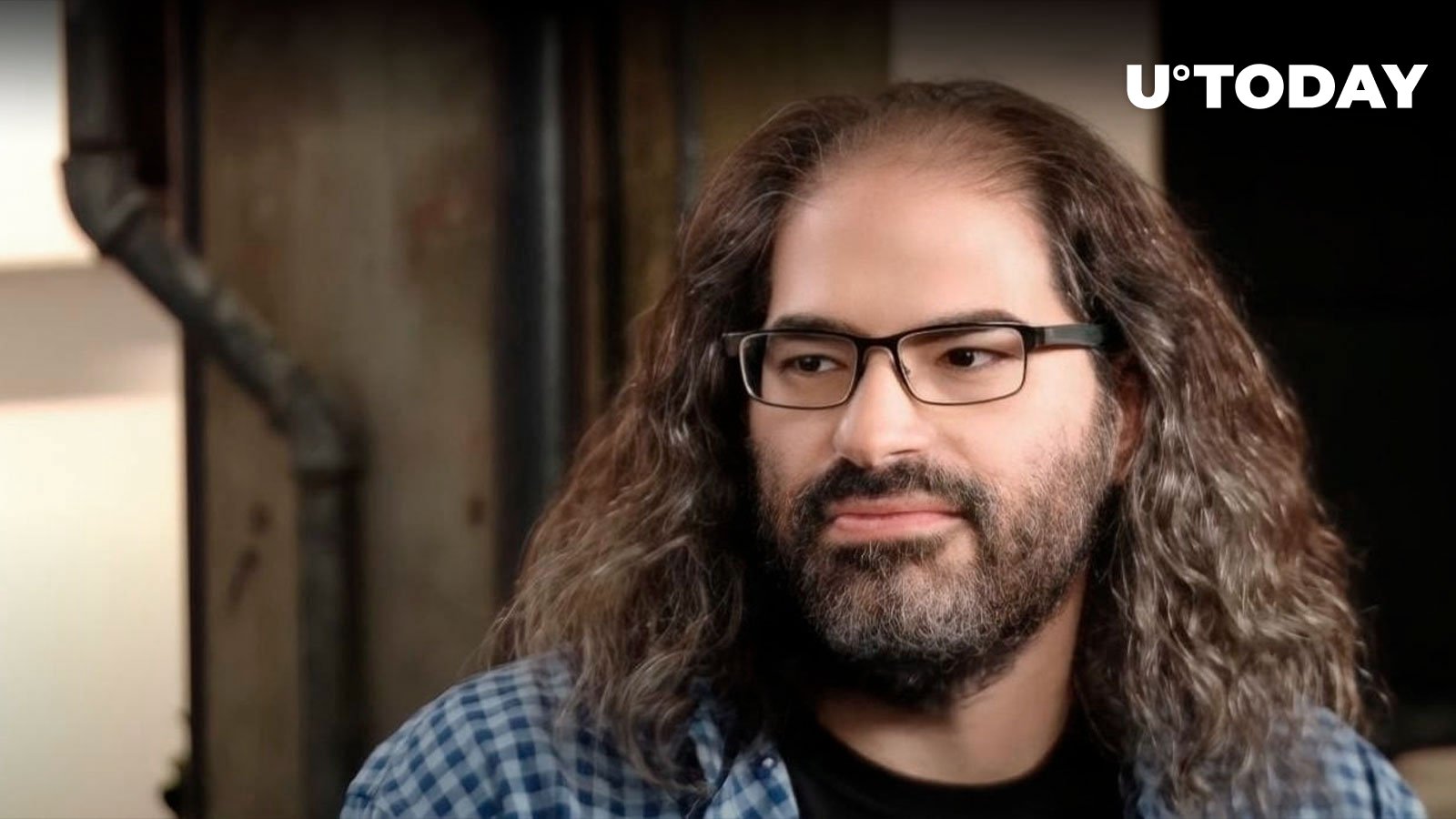

David Schwartz, chief technology officer at Ripple known in the crypto community as “JoelKatz,” recently shared his views on the nature of the XRP token.

In a series of posts, Schwartz clarified that he sees XRP, like most cryptocurrencies, as a high-volatility asset that investors hope will appreciate over time, rather than a “lottery ticket” offering a chance for a sudden, significant financial windfall.

“I don’t think of it as much as a lottery ticket with a chance of a sudden large increase, though there’s certainly some truth to that,” he said.

In the XRP community, discussions around the token and its potential for generating passive income have intensified, especially with the activation of the XRP Ledger (XRPL) automated market maker (AMM).

Unlike staking mechanisms where holding a cryptocurrency can yield passive income, participating in an AMM requires providing liquidity by trading XRP for claims against the AMM pools.

This participation does not guarantee a fixed return. This shows a common misconception among some investors regarding the nature of DeFi products and the associated risks.

The activation of the XRPL AMM has led to misconceptions, particularly around the notion of earning passive income simply by holding XRP.

The clarification aims to educate and temper unrealistic expectations, promoting a more informed and realistic approach to participating in XRPL’s DeFi features.

Discussions within the XRP community have also touched on the topic of burning the excess XRP held in escrow.

Calls for a vote on this matter have been met with a response from Schwartz, who emphasized the principle of ownership and control in the cryptocurrency space.

He argued that the decision to burn XRP or any asset should remain with the asset’s owner, reinforcing the foundational crypto principle of individual control over one’s digital assets.