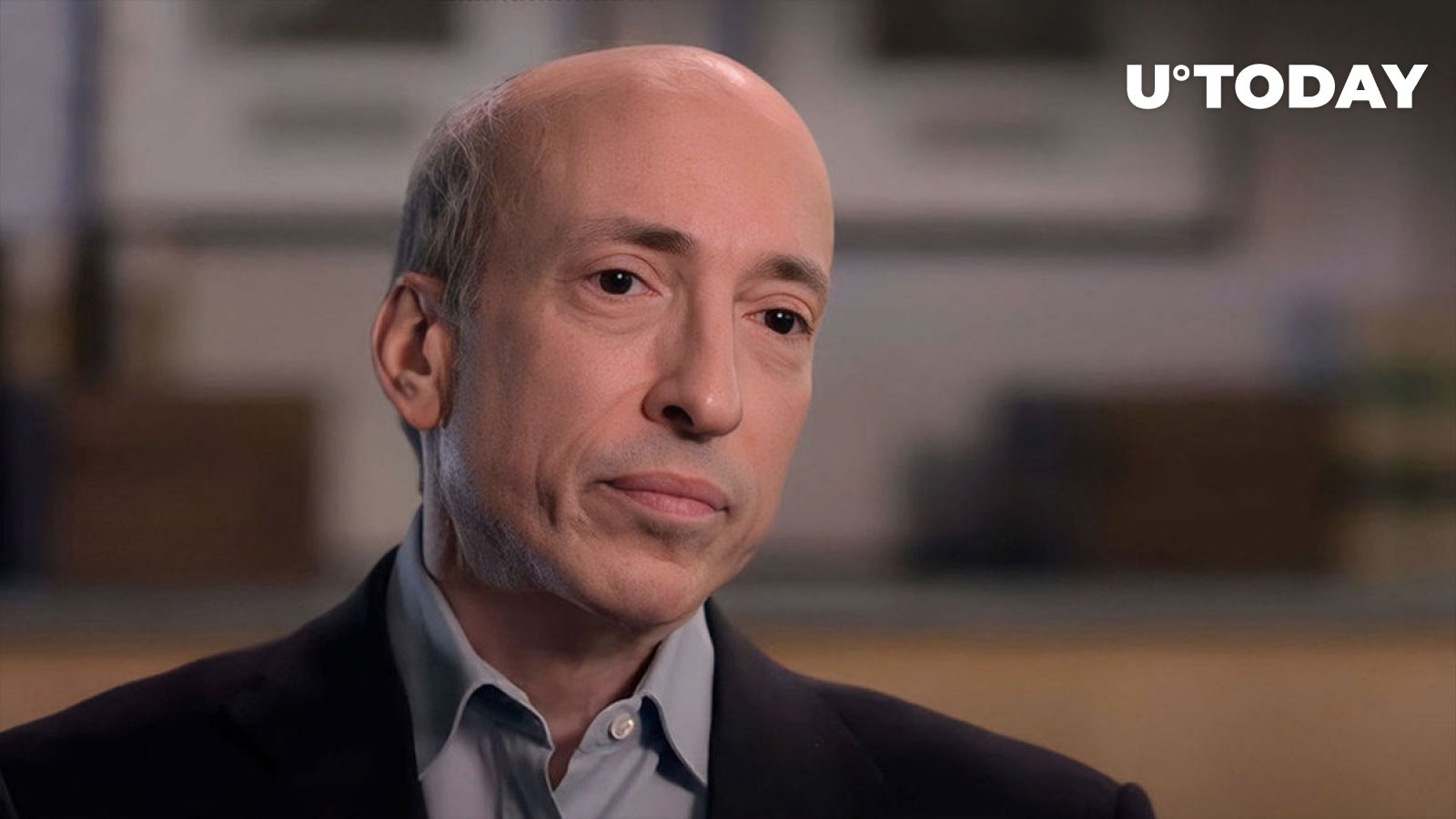

During a recent interview with Bloomberg, Securities and Exchange Commission (SEC) Chairman Gary Gensler pointed to the volatile nature of cryptocurrencies like Bitcoin and Ether, cautioning investors about the inherent risks.

“This is a highly speculative asset class,” Gensler said, emphasizing the dramatic price fluctuations experienced by these digital assets.

The conversation also touched on the topic of cryptocurrency regulations.

Gensler’s warnings come amid growing concerns over the stability of investments in cryptocurrencies after they experienced a rollercoaster ride.

“One could just look at the volatility of Bitcoin in the last few days,” he pointed out, arguing that the thrill of investing in these markets might not be for everyone, especially those averse to high-risk financial rides.

He further noted the foundational issues underlying these digital assets, questioning, “How firm is the foundation of that? You know, you get to the top of that hill. How is the foundation underneath it?”

On the topic of crypto regulations, Gensler remained cautious. He spoke about the complex nature of determining whether digital assets like Ether are securities or commodities.

As reported by U. Today, Gensler has repeatedly dodged questions about Ethereum’s regulatory status.

He once again stressed that the SEC’s approach depends on “the facts and circumstances as to whether the investing public is anticipating a profit based on the efforts of others.”