Uber Eyes Crypto Solution for Faster, Cheaper International Payouts

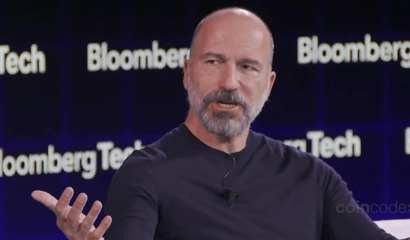

Uber (UBER) CEO Dara Khosrowshahi spoke on June 5, 2025, at the Bloomberg Tech Summit in San Francisco and announced that Uber is seriously considering using stablecoins to make cross-border payments easier. Dara Khosrowshahi speaking at Bloomberg Tech Summit, June 5, 2025. Source: BloombergWith an organization operating in more than 70 nations and processing millions of transactions each month, the possibilities are gigantic.Khosrowshahi characterized old-school cross-border payments as friction-infested. Bank wires cost up to $30 per transaction and take days to clear, and each payment passes through a maze of intermediaries. Stablecoins, digital tokens pegged to fiat currencies like the US dollar, settle transactions in minutes, typically for less than one dollar.The following table compares the transfer fee and settlement time between traditional bank transfers and stablecoins:The numbers are compelling. In new data by PYMNTS, cross-border transfers by traditional banks cost $10–$30 and take three to five business days. Stablecoin transfers, on the other hand, typically range from $0.10 to $0.50 and settle in less than an hour. For Uber, which pays out to drivers and vendors all over the world, the savings could run to tens of millions of dollars per year.Khosrowshahi told Bloomberg:”Stablecoins are one of the more intriguing uses of crypto that actually have a real use case that’s not just storing value. In order for international businesses to transfer money across borders, this could be a huge cost savings.”This is Uber’s second foray into crypto – Uber was a key backer of Meta’s Libra (now Diem) stablecoin project in 2019 and experimented with Bitcoin payments since 2021, but environmental issues and volatility shelved those plans. Having stablecoins like USDC and USDT gain popularity and regulatory clarity improve step by step, Uber’s interest has shifted from speculative assets to blockchain infrastructure that can solve real business problems.The words of Khosrowshahi come at a moment when corporate crypto adoption is gaining momentum. Visa, PayPal, and Shopify are already piloting stablecoin payments, while BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL) has captured more than $460 million in assets. Even Trump Media recently unveiled a $2.5 billion Bitcoin treasury plan. The message couldn’t be clearer: digital assets are making the transition from the fringe of finance to the mainstream of global commerce.Clearly, however, there are challenges to be addressed. Regulatory uncertainty is the greatest challenge, at least in the U.S., where politicians are yet to come to an agreement on what the rules for stablecoin issuers should be. Khosrowshahi was quick to signal that Uber remains at the “study phase” and will not move forward without legal certainty. Security and transparency are top of everyone’s minds, following recent scandals over stablecoin reserves. Circle’s USDC, whose 100% cash-backed structure, has emerged as an Institutional darling seeking trust and reliability.If Uber proceeds, the benefits would be historic. Payment processing costs would decrease by over 90%, driver payments would be nearly instant in markets like Latin America and Southeast Asia, and riders and drivers alike would see simpler, more transparent exchange of currencies, specially in volatile economies.As Khosrowshahi described:”This isn’t about crypto hype — it’s about solving real business problems.”TradingView charts were observing a marginal rise in USDC and USDT volumes as speculation about what Uber is going to do next raged on.Stablecoin Market Cap. Source: CoinGlassUber’s foray into stablecoins could be a watershed moment for cryptocurrencies. By using blockchain to address pain points in cross-border finance, Uber is not just following the herd — it is leading the charge. The world will wait to see whether the ride-hailing behemoth can bring stablecoins into the mainstream, radically changing the way we travel, and indeed, the way we send money globally.Get Started on eToroeToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

Published on Other News Site