Weekly Crypto Recap: Paul Atkins Sworn In, TRUMP Whale Dinner, and Zora Criticism

Bitcoin started last week at $86,600. During the day, the price hovered around the levels seen at the beginning of the month, above $87,000.The rise of the first cryptocurrency coincided with gold reaching a new high of $3,389 per troy ounce. Futures on major U.S. stock indexes continued to fall.”Bitcoin’s breakout above $87,000 is driven by increased global liquidity associated with the expansion of the money supply and renewed institutional interest, underscored by [Strategy’s] signals to further build their assets and reduce available supply,” Kronos Research analyst Dominic John commented for The Block.According to data from a CryptoQuant analyst under the nickname Darkfost, open interest (OI) in perpetual Bitcoin contracts soared by 17.4% at the end of April 21.Comparable jumps of 16% and 15% were seen during a strong bull phase in November-December 2024. At that time, activity in derivatives reinforced the positive trend in the spot market, the specialist specified.Later, Glassnode analysts noted that over the past day, the OI on Bitcoin futures rose by $2.4 billion, to a maximum of $38.6 billion since March. The trading volume of the first cryptocurrency on spot exchanges jumped threefold, from $2.9 billion to $8 billion.On April 22, the price passed the $90,000 mark for the first time since early March. The Fear and Greed Index moved into the “neutral” zone for the first time in a month.According to analyst Miles Deutscher, one of the drivers was the largest influx of new whale investors in the history of the first cryptocurrency.We’re currently witnessing the largest increase in new whales in $BTC history.

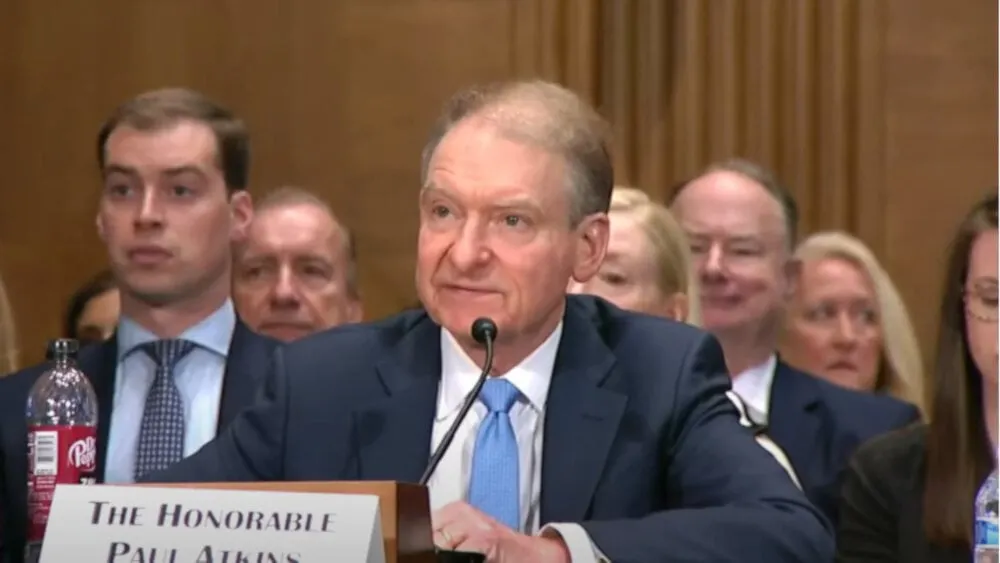

Whales are stacking BTC at a record pace. pic.twitter.com/XYM8bGPuFIAnother important event was the record difference between Bitcoin capitalization and the total market value of altcoins. This reflects the strengthening of the first cryptocurrency’s position in the market, emphasized WeRate co-founder Quinten Francois.Biggest gap between Bitcoin and altcoins EVER ūüö® pic.twitter.com/tDIcZlTTzTOn April 23, amid conciliatory statements by US President Donald Trump on tariffs and the head of the Federal Reserve, the price of the first cryptocurrency crossed the $94,000 mark.The comments sparked a burst of enthusiasm in the stock markets and became a catalyst for the continued growth of the first cryptocurrency, which had consolidated above $90,000 the day before.An additional factor was the liquidation of shorts. From April 22 to April 23, the volume of forcibly closed positions in the cryptocurrency market amounted to $632.6 million, including shorts for $557.2 million.Liquidation Heatmap. Source: CoinGlass166,792 traders were subjected to the procedure. About half of the liquidations came from Bitcoin ($314.9 million).Against the backdrop of Trump’s change of rhetoric, the total volume of open positions increased by 10% to $17.83 billion.¬†The pace was the highest since March 2, when Trump mentioned XRP, ADA and SOL as potential candidates for inclusion in the cryptocurrency reserve in addition to Bitcoin and Ethereum.On April 24, the price pulled back to $92,000, but by the end of the day it was back to $94,000.¬†A CryptoQuant contributor under the nickname oinonen_t noted that the first cryptocurrency’s correlation with the Nasdaq and S&P 500 stock indexes has noticeably decreased.”The correlation with the S&P 500 index, which was as high as 0.88 at the end of 2024, has fallen to 0.77. A similar trend is observed in relation to Nasdaq Composite ‚Äď from January, the index has fallen from 0.91 to 0.83,‚ÄĚ stated the expert.The analyst also noted the growing correlation of Bitcoin with gold, since the beginning of the month, the coefficient has increased from -0.62 to -0.31. Both assets “share the attribute of scarcity, although the former is a more limited resource.”On April 25, the chart reached a weekly high above $95,400. The price gradually fell over the next few days, except for a local peak near $95,000 on the night of April 27.At the time of writing, Bitcoin is trading at $94,000. The gain for the week amounted to 10.5%.Ethereum opened the week at $1,600. On April 21, the price reached $1647, but sagged below $1600 by the end of the day.On April 22, the growth continued. During the day, the price rose by 11.7% ‚Ästfrom $1,568 to $1,751.The next day, the chart stabilized around $1,800.¬†On April 24, the price dropped to $ 1,736, but after that, it began to experience gradual growth.¬†On the night of April 27, the chart reached its weekly maximum of $ 1,840.At the time of writing, Ethereum is trading at $1,797. The gain for the week amounted to 12.3%. Over the past seven days, all assets from the top 10 list by capitalization showed positive dynamics. In addition to BTC and ETH, Dogecoin (+17%), ADA (+13.5%), and SOL (+9%) saw the biggest gains. The total capitalization of the crypto market grew by 10.5% to $3.07 trillion.On April 21, Paul Atkins took the oath of office as the new chairman of the U.S. Securities and Exchange Commission.U.S. President Donald Trump has nominated him to run in December 2024. Many crypto industry participants saw him as a suitable candidate given his experience in the industry.On April 10, the Senate voted to confirm Atkins to the position. Fifty-two senators were in favor, 44 House members voted against, and four did not participate in the proceedings.The new head of the Commission called the creation of a clear and understandable regulatory framework for digital assets his priority. He emphasized that he intends to focus on increasing market transparency and strengthening investor protection.Atkins’ appointment marks a change of course for the SEC. His approach differs from former head Gary Gensler, who often relied on “coercive regulation.”Prior to his confirmation, the agency’s new chairman served as a board member of The Digital Chamber, a nonprofit organization. The group focuses on promoting and lobbying for blockchain technology, Bitcoin, and other cryptocurrencies in U.S. policy circles.Atkins served as SEC commissioner from 2002 to 2008, where Trump said he “strongly advocated for transparency and investor protection.”U.S. President Donald Trump announced a gala dinner for the 220 largest holders of the TRUMP memecoin. The event will be held on May 22 at his private golf club in Washington, DC.Participants can increase their chances of an invitation by holding coins between April 23 and May 12. The more TRUMP in the account, the higher the chances of getting to the dinner. A leaderboard has been published on the project’s website.Of the 220 invited, the top 15 holders will be able to get into an “exclusive reception” before the dinner with Trump and get a “VIP tour of the White House”.Democratic U.S. Senator Jon Ossoff of Georgia described the event as “exceeding any previous standard for impeachment.””When a sitting president of the United States sells access for what are effectively payments to him directly, there is no question that it rises to the level of an impeachable offense,” the senator said.Ossoff said he fully supports the idea of impeachment, but believes it is impossible under the current composition of the House of Representatives, which is responsible for such decisions.Amid the announcement of the gala dinner, the price of TRUMP rose 54% within a few hours, approaching $14.5.On April 20, social NFT content monetization platform Zora announced the issuance of 10 billion ZORA tokens in L2 network Base. The launch was scheduled for April 23.On the scheduled day, users started receiving ZORA without prior warning. Community members criticized the platform for the lack of official announcements.Bidding started without announcement, and only experienced users could access ZORA directly from the smart contract address on the Base network. Newcomers encountered difficulties – the process was more complicated than usual giveaways.Exchanges Binance, Bitget, and Bybit have received ZORA “worth millions of dollars” to enable efficient trading. Decentralized exchange Hyperliquid has launched leveraged options.According to Arkham Intelligence, turnover on and off the platform totaled about $6 million.The ability to get tokens before the official TGE may have created an unfair advantage for early users, leading to criticism.One X user called the launch a “master class in cheating” due to a lack of communication from Zora. He also pointed to promotion of the platform by Base creator Jesse Pollack.According to BitOK, the Zora team sent almost all of the drop to their own wallets.¬†Some of these addresses were linked to the Bybit and KuCoin exchanges, raising suspicions of corruption in asset allocation. Wallets with more than 100 million ZORA have also been spotted.”They definitely appropriated some of the coins and definitely sold them before the announcement,” declared BitOK founder Dmitry Machikhin.He emphasized that initially, Zora representatives owned 65% of the total token allocation. According to the speaker, his team will conduct an independent investigation and collect evidence to prove their guilt.According to Drophunter under the nickname Anton ProfiT, the Zora team promised automatic allocation before listing, but within the first 2.5 hours began selling tokens on the exchange “at a good price.” Only after that did the representatives “quietly open the portal to receive tokens”.Zora promoted a referral program but banned the most active users for it, Anton ProfiT emphasized.He revealed that his wallet was showing a distribution of 34 million ZORA. After a “30x reduction”, the drophunter claimed more than 1 million tokens. However, he was blocked “for being too active”.”Zora is not Web3. This is a centralized scam disguised as decentralization,” concluded Anton ProfiT.At the time of writing, ZORA is trading at $0.0169, 57% below its peak of $0.04.Ethereum developers are considering more than quadrupling the network’s gas limit as one of the key features of the planned hardfork, Fusaka.¬†The ACDE proposal EIP-9678 presented during the call calls for testing the parameter with a cap of 150 million units. In February, Ethereum validators supported raising the gas limit from the 30 million level. According to Ycharts, the value increased by ~20% to 35.95 million.”To align customer defaults and keep this as a priority, we put together a draft EIP. It’s a bit unconventional, but not unprecedented (see EIP-7840). We plan to merge it early next week for the upcoming ACDE,” commented core developer Tim Beiko.The proposal would require changes to other EIPs for Fusaka, but the scope of the hardfork would not change, he noted.Regarding the need to raise the gas limit, developers led by Sophia Gold noted that there is a lot of interest in scaling the L1 execution layer. But without introducing new features, working towards this would take time for customer teams to identify and fix bugs. That’s why it made sense to formalize this as an EIP and include it in the hardfork, the experts added.The Pectra upgrade is scheduled for May 7. Fusaka’s activation is expected to take place in late 2025.

Published on Other News Site